Tired of high electricity bills? Many people struggle with rising energy costs and wonder if there’s a smarter way to save money. Solar panels might be the answer you’re looking for.

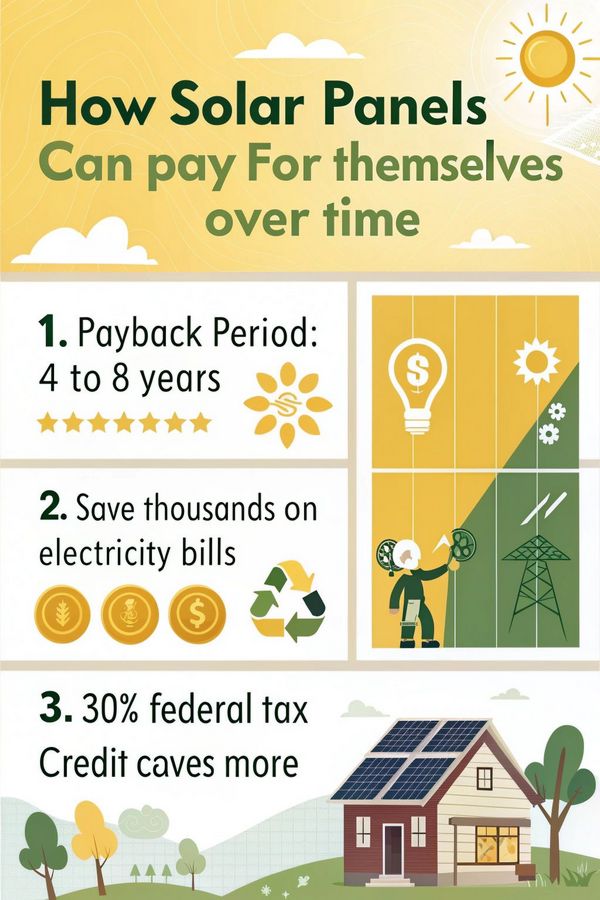

On average, solar panels can pay for themselves in under eight years. After that, your energy costs drop dramatically. This blog will explain how this works, what impacts the payback period, and why solar is a smart investment.

Ready to see how solar can save you money? Keep reading!

Understanding the Solar Panel Payback Period

The solar panel payback period tells you how long it takes to recover your investment. It shows when the savings from lower energy bills cover the cost of installation.

Definition of Solar Panel Payback Period

Solar panel payback period is the time it takes for solar panels to save enough money to cover their upfront cost. For most EnergySage users, this is less than eight years. After this period, energy costs stay stable while savings grow.

Solar systems often qualify for a 30% tax credit on installation costs. This reduces the payback time further. Some homeowners see solar paying off in just four-and-a-half years and can save up to half a million dollars over time!

Importance of Knowing the Payback Period

Knowing the payback period helps you plan your solar energy investment. Most systems pay off in under eight years, but some can take less than four and a half years. This time frame shows when savings on electricity will match the upfront cost of installation.

Tracking this period is important for long-term financial planning. A system provides flat energy costs after it’s paid off, offering decades of savings. Homeowners who claim the 30% tax credit may also shorten their payoff time while enjoying reduced utility bills each year.

Factors Influencing Solar Payback Period

Many things affect how soon your solar panels pay for themselves. These include costs, usage, and savings—each playing a big role in the payoff timeline.

Initial Cost of Solar Panels

The upfront cost of solar panels can vary widely. On average, homeowners spend between $15,000 and $25,000 for installation. This price depends on the size of the system and location.

A 30% federal tax credit helps reduce this initial expense. For example, a $20,000 system could get a $6,000 rebate through this program.

Solar panel costs have dropped by over 70% in the past decade. While still significant, these savings make solar power more accessible to families today. Homeowners should also factor in state or local rebates that lower costs further.

Electricity Production Capacity

Solar panels generate electricity using sunlight. The amount produced depends on their size, efficiency, and the sun’s strength in your area. Most solar systems can cover a big part of a home’s energy needs.

Over time, this reduces utility costs significantly.

Once installed, solar panels keep producing power for 25 years or more. Electricity production stays steady after the payback period is reached. This means long-term savings while protecting against rising energy prices!

Average Monthly Electricity Usage and Cost

Most homeowners spend hundreds on electricity bills each month. The national average is about $120. Installing solar panels can cut those bills drastically, sometimes to nearly zero.

By switching to clean energy, you save thousands over the years.

To figure out savings, check your monthly electric bill. Multiply it by 12 for yearly costs—this shows how much you could save annually with solar power. Over time, reduced utility expenses help pay back the upfront cost of installation quicker!

Available Tax Incentives and Rebates

Homeowners can get a 30% tax credit on their income taxes. This applies to the cost of installing solar panels. It lowers the upfront cost and shortens the payoff period.

States may offer extra rebates or incentives for solar energy systems. These savings make going solar even more affordable and help reduce electricity costs faster.

Calculating Your Solar Payback Period

Calculating Your Solar Payback Period: You can figure out how long it takes for solar panels to pay for themselves with a simple method—keep reading to see how this works!

Formula for Calculating Payback Period

Divide the total cost of installing solar panels by annual savings on electric bills. For example, if you spend $20,000 on solar installation and save $2,500 yearly, your payback period is 8 years.

The formula helps see how quickly you recover your upfront cost. Many homeowners also claim a 30% tax credit, reducing the overall expense and shortening this period.

Example Calculation

Calculating how long it takes for your solar panels to pay off is simple. Use basic numbers to see how much time and money you’ll save.

1. Determine the upfront cost of solar panels

A typical system costs $20,000 before tax credits.

2. Apply the 30% tax credit

Subtract $6,000 (30% of $20,000). This lowers the cost to $14,000.

3. Assess yearly electricity savings

Homeowners save about $1,500 a year on power bills with solar energy.

4. Divide total cost by annual savings

Divide $14,000 by $1,500. The payback period is about 9.3 years.

5. Review other rebates

Some states offer extra perks or rebates that cut costs further and shorten the payoff period.

6. Factor in rising utility rates

Electricity rates increase over time. Your savings grow each year, speeding up your return on investment.

This example shows how solar energy creates significant financial benefits over time!

Impact of Financing Options on Payback Period

The way you pay for your solar panels can make a big difference in how fast they pay for themselves—read on to see why!

Buying vs. Leasing Solar Panels

Sure! Here’s a section about buying vs. leasing solar panels formatted in HTML table format:

Buying or leasing solar panels is a big decision. Both options have their pros and cons, especially when considering the solar payback period. Here’s a quick breakdown:

| Factor | Buying Solar Panels | Leasing Solar Panels |

|---|---|---|

| Ownership | You own the system outright. It’s a long-term investment. | The leasing company owns the system. You pay to use it. |

| Tax Incentives | You can claim a 30% federal tax credit for installation costs. | You don’t qualify for tax breaks because you’re not the owner. |

| Initial Cost | Higher upfront installation costs, but no recurring lease payments. | Little to no upfront cost, but you’ll have monthly payments. |

| Monthly Savings | Higher savings on electricity bills after the system is paid off. | Moderate savings since you still pay the leasing company. |

| Payback Period | Typically under eight years for most homeowners. | No “payback” since you never own the system. |

| Home Value | Ownership increases your home value. | Leased panels may make selling your home trickier. |

| Maintenance | You’re responsible for any maintenance, though panels are durable. | The leasing company usually handles maintenance for you. |

Buying solar panels leads to long-term savings. Leasing, on the other hand, offers lower upfront costs but smaller financial gains.

Loan Options and Their Effects

Loan options can significantly impact how quickly solar panels pay for themselves. Let’s break it all down in a simple, clear way:

| Loan Option | Details | Impact on Payback |

|---|---|---|

| Solar Loans | Homeowners can borrow the upfront cost of solar installation. Monthly payments are made over a set period, often between 5-20 years. | Payback period may extend slightly due to interest. Still, monthly savings from lower utility bills can offset loan payments. |

| Home Equity Loans | Uses equity in your home to finance solar panels. Offers lower interest rates compared to traditional loans. | Lower borrowing costs mean a shorter payback period. Savings from reduced utility bills start quickly. |

| Personal Loans | Simple option to cover solar costs without needing home equity. Interest rates can vary widely. | Higher rates may stretch payback periods. Carefully compare lenders to reduce added costs. |

| PACE Loans | Property Assessed Clean Energy loans are repaid via property taxes. Offered in specific states. | Convenient repayment method. Terms may vary, so research local policies. |

Monthly loan payments depend on loan amount and terms. Tax credits like the 30% solar installation credit can lower the principal amount, reducing financial strain.

State-Specific Solar Payback Periods

Solar payback periods can vary a lot depending on your state—check how your location affects savings!

Comparison of Payback Periods in Different States

Different states offer varying payback periods for solar panels due to factors like utility rates, incentives, and sunlight availability. Here’s a summary comparing payback periods across a few states:

| State | Average Payback Period (Years) | Key Factors |

|---|---|---|

| California | 5-6 | High electricity rates, extensive sun exposure, 30% federal tax credit |

| Texas | 7-8 | Lower installation costs, average utility rates, net metering policies |

| New York | 6-7 | State tax credits, high utility rates, winter weather impacts production |

| Florida | 5-6 | No state income tax, abundant sunshine, moderate utility costs |

| Arizona | 4-5 | High solar production capacity, generous state incentives, favorable climate |

Sunlight hours differ widely. Arizona benefits from longer hours—a big factor in the 4-5 year range. In contrast, states like New York face seasonal changes, slightly lengthening the timeline there. High electricity costs in California push payback periods lower despite the upfront expense.

Long-Term Financial Benefits of Solar Panels

Solar panels can save you money on electricity bills for years. They might even make your home worth more if you sell it.

Annual Savings on Electricity Bills

Homeowners save a lot on electricity after installing solar panels. The average savings come from multiplying the monthly utility bill by 12. For example, if your bill is $150 each month, that’s $1,800 saved annually.

Energy costs remain flat once the system is paid off. This means no more rising bills! Solar power can deliver savings of up to half a million dollars over time for some households.

Reduced utility costs make a big difference in long-term budgets.

Increased Home Value

Solar panels can raise a home’s value. Studies show that homes with solar systems sell for more money than those without. Buyers often like the idea of saving on electricity bills right away.

A 30% tax credit also lowers installation costs, making solar panels more appealing. This mix of savings and added value makes them smart for many homeowners.

Must Known Things About Solar Investment

Many people wonder how solar panels affect their monthly bills and overall savings. Others ask common questions about costs, maintenance, and long-term benefits.

Will You Still Have an Electric Bill –

Yes, but it will be lower. Solar panels reduce your need for energy from the grid. If your system does not produce enough power, you’ll pay for the extra electricity you use. This is common at night or in bad weather.

Your bill could even reach zero with enough panels and sunlight! Homes in sunny states often see this benefit more quickly. Some months, you might get credits if you make extra energy and send it back to the grid.

This depends on your utility’s rules and rates where you live.

Savings From Solar Each Month :

Solar panels can save homeowners hundreds of dollars every month. Multiply your average electricity bill by 12 to see yearly savings. For example, if you pay $150 monthly, that’s $1,800 saved each year.

Over time, this adds up to big financial benefits.

These savings depend on your system’s size and energy needs. On average, solar power can pay for itself in just over four years. With a 30% federal tax credit on installation costs, the payoff happens even faster!

Conclusion

Solar panels make sense for saving money. They cut electric bills, add home value, and pay off over time. With tax credits and lower energy costs, they’re a smart choice. Install them once, and enjoy years of savings ahead! Your wallet—and the planet—will thank you.

Frequently Asked Questions (FAQs)

1. How do solar panels pay for themselves over time?

Solar panels save money by cutting your electricity bills. Over time, the savings add up and cover the cost of installation.

2. Can solar panels reduce energy costs immediately?

Yes, they can! Once installed, you’ll start using less power from the grid—which means lower monthly bills right away.

3. Do all homes benefit equally from solar energy?

Not always. Homes in sunny areas see bigger benefits since more sunlight means more energy production (and savings).

4. Are there extra incentives to make solar panels worth it?

Absolutely! Many places offer tax credits or rebates that help offset installation costs, making it easier for them to pay off faster.