Owning a home has become harder for middle-class families. Prices are high, wages have not kept up, and mortgage rates continue to rise. Many people feel stuck renting or living in cramped spaces because buying a house seems impossible.

Right now, the housing crisis is hitting the middle class hard. Around the world—in places like the U.S., China, and Europe—home prices are soaring while inventory stays low. This blog will break down why this is happening and how it affects families’ finances, stability, and future plans.

Stay tuned… there’s more to unpack!

Factors Contributing to the Housing Crisis

Housing problems don’t just happen overnight—they build up over time. Many things work together, making it harder for families to afford homes.

Limited housing supply

Fewer homes are available for middle-class families. This shortage has driven up prices, making homeownership harder. Since 2023, high demand and limited inventory have caused housing costs to soar in areas like the United States and European Union.

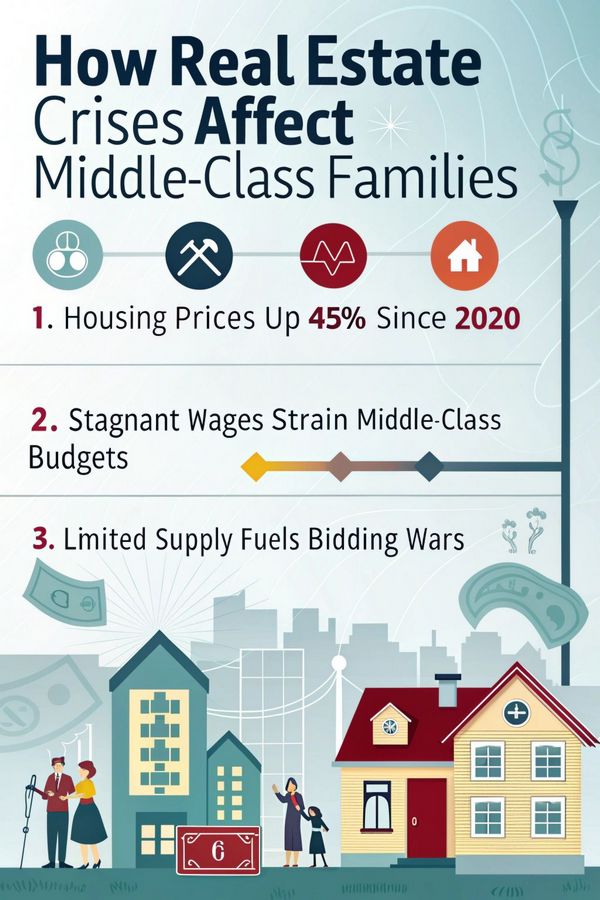

Low supply forces families into bidding wars or pushes them toward renting instead of buying.

Developers aren’t building enough affordable homes to help meet demand. Rising material costs and zoning restrictions slow construction further. As a result, many middle-income households can no longer afford decent housing close to work or schools.

The crisis is squeezing budgets and leaving fewer options for stable living situations.

Stagnant middle-class wages

Middle-class incomes have barely grown while housing costs keep climbing. Around one-third of families now earn less than before, making it harder to afford homes. Prices rise, but paychecks stay the same—this makes saving for a down payment almost impossible.

Limited growth in wages widens wealth inequality. The middle class depends heavily on their homes as assets. Without higher earnings, many cannot compete in the rising market or handle expensive mortgages and living costs.

Rising mortgage rates

Mortgage rates have climbed fast, making homes harder to afford. In 2023, many middle-class families faced higher monthly payments because of these rising rates. Some could no longer qualify for loans at all.

With home prices already high and wages stagnant, this added pressure hurts their chances of buying a home.

Higher rates also widened wealth gaps. Wealthier people with more savings can still buy houses or pay cash. Meanwhile, those relying on loans struggle even more. These challenges leave many stuck renting long-term or delaying buying dreams altogether.

Increased homeownership costs

Homeownership costs have jumped for middle-class families. Rising property prices and mortgage rates make buying a home harder. Stagnant wages add to the struggle. Many can’t keep up with these changes.

Two-thirds of families may see higher incomes, but high housing costs eat away at gains.

Low housing supply worsens the problem. There aren’t enough affordable homes available. This leaves many stuck renting or living in smaller spaces. As prices soar, some fear they’ll never afford their own house again.

Immediate Effects of the Housing Crisis on Middle-Class Families

Families feel the pinch as housing gets pricier, making day-to-day life more stressful—read on to see how deep this issue runs.

Decreased home affordability

Home prices keep rising, but wages stay the same. Many middle-class families can’t afford to buy a home anymore. Limited housing supply makes it worse. Fewer houses mean higher costs for buyers.

High mortgage rates add even more pressure. Monthly payments are now too expensive for many.

In places like the U.S., China, and Europe, this problem is growing fast. Middle-income families feel stuck renting instead of owning homes. They lose chances to build wealth through property ownership.

For some, buying a house has become nearly impossible without big financial help from others—like parents or family savings plans.

Increased financial stress and insecurity

Rising mortgage rates and soaring housing costs have put middle-income families under pressure. Many struggle to pay monthly bills, often dipping into savings or taking on more debt.

About one-third of families now face falling financial stability due to housing costs.

Low home supply and stagnant wages make it even harder to keep up. Families who once dreamed of buying homes are staying in rentals longer, which keeps them from building equity. Inflation also adds stress by raising everyday expenses like food and gas alongside housing payments.

Delayed home buying among young adults

High housing costs make it hard for young adults to buy homes. Many are stuck renting because of high prices, low supply, and stagnant wages. Mortgage rates are also too expensive for most first-time buyers.

The rising cost of living adds extra pressure. Education expenses and inflation drain savings needed for a down payment. This delay in buying homes stops them from building wealth early in life.

Compromised living conditions

Families often settle for smaller, overcrowded homes due to rising housing costs. Many middle-class households now live in older or poorly maintained properties because affordable options are scarce.

Expensive housing also forces families into areas with fewer resources. This means limited access to good schools, safe neighborhoods, and stable jobs—all critical for a better quality of life.

Long-Term Impacts on Middle-Class Families

Owning a home often helps families build wealth over time, but the housing crisis makes this much harder. Rising costs and fewer options leave many stuck renting, which limits their financial growth.

Barriers to wealth accumulation

High housing costs eat into savings for middle-income families. Rising mortgage rates and limited inventory make it hard to buy homes, which are key for building wealth. Many spend more on rent, leaving little money for emergencies or investments.

The housing market crash worsened wealth inequality. Middle-class families rely heavily on their homes as primary assets. Falling property values during crises erase years of financial progress.

Without affordable options, passing wealth to the next generation becomes harder too.

Diminished generational wealth transfer

Middle-class families rely on homeownership to pass wealth to their children. Rising housing costs and mortgage rates make this harder. Many parents struggle just to keep their homes, leaving little to pass down.

The housing crisis also limits opportunities for younger generations. High property values force young adults into rental markets instead of buying homes. Without owning property, they lose a key way to build assets over time.

Increased reliance on rental housing

Housing costs keep rising, pushing many families to rent. With home prices soaring and wages staying flat, middle-income households often can’t afford mortgages. Limited housing supply makes it even harder for them to buy homes.

More people renting means higher rental rates. This adds financial stress as families spend a bigger chunk of income on rent. Without owning property, building wealth or saving for the future becomes tough.

Geographic Variations in the Housing Crisis

The housing crisis hits different places in different ways—some areas feel it worse than others. Keep reading to see how location changes the story!

Case studies: United States, China, European Union

Real estate crises hit people differently across the world. Middle-class families in the U.S., China, and Europe face unique struggles due to housing issues.

- United States:

- Housing prices soared by 45% between 2020 and 2023 due to low supply.

- Mortgage rates climbed above 7%, making homes unaffordable for many middle-income families.

- Families rely heavily on their homes as assets, increasing wealth inequality when property values drop.

- First-time buyers struggle because strong competition keeps house prices high despite economic slowdowns.

- China:

- A real estate boom turned into a crisis after overbuilding left many empty units by 2022.

- Developers like Evergrande defaulted on loans, causing market instability and financial distress for homeowners.

- Urban areas saw skyrocketing property costs that middle-class families couldn’t keep up with.

- Generational wealth transfer became harder, as falling home values wiped out savings tied to real estate.

- European Union:

- Countries like Germany and Spain experienced rental rate hikes of up to 20% from 2018-2023.

- Middle-income households spent more than 40% of earnings on housing in some regions.

- Limited housing inventory increased financial stress among young adults delaying home purchases.

- Rising inflation worsened affordability, leaving families dependent on renting instead of owning homes.

Regional disparities in housing affordability

Housing affordability varies across regions. In the United States, middle-class families in cities like San Francisco or New York struggle with skyrocketing home prices. Limited housing supply worsens this issue, pushing costs even higher.

In Europe, major cities face similar problems. Rising prices and low inventory make it hard for middle-income families to buy homes. China also experiences unaffordable housing in urban areas due to rapid development and demand outpacing supply.

These regional gaps highlight differing challenges worldwide.

Policy Responses and Their Effectiveness

Governments are trying different ways to fix housing problems, but do they really help?

Government initiatives to increase housing supply

Increasing housing supply is a major goal for many governments. Efforts to tackle high prices and shortages affect middle-class families directly.

- Building affordable homes

Governments support programs that fund new, affordable homes. For example, the U.S. provides tax credits to builders creating low-cost housing. - Easing zoning rules

Some cities change zoning laws to allow more apartments and smaller homes. This makes it easier to build in high-demand areas. - Offering subsidies

Many nations offer money to developers who build housing for middle-income families. This lowers construction costs and encourages more projects. - Releasing public land

Land owned by the government gets sold or leased cheaply for housing developments. Using this land helps create space for more homes quickly. - Encouraging private partnerships

Private companies team up with governments to speed up building projects. These partnerships increase resources and workforce availability. - Expanding home loans

Programs like FHA loans in the U.S., reduce down payments, helping middle-class buyers afford their first homes. - Investing in infrastructure

Better roads, schools, and utilities draw developers to build in less crowded areas. Middle-class families benefit from increased options nearby. - Removing red tape

Cutting back on permits or simplifying regulations speeds up construction times nationwide, ensuring faster growth of the housing market. - Preventing unused properties

Vacant lots or unused buildings face penalties in some cities until they are turned into livable spaces. - Supporting community projects

Local co-op initiatives receive grants or aid for shared housing developments designed for working families in need of affordable options.

Rental regulation policies

Rental regulation policies aim to control rent prices and protect tenants. These rules can cap annual rent increases, making housing more affordable for middle-income families. In cities with high demand, like New York or San Francisco, such policies help renters avoid sudden price hikes.

Some argue these regulations reduce landlords’ motivation to maintain properties or build new ones. This creates fewer rental options over time, pushing up housing costs elsewhere.

Middle-class households face limited choices as a result, increasing their reliance on older rentals with higher repair needs.

Impact assessment of current policies

Government initiatives to increase housing supply have fallen short. Limited inventory remains a major issue, keeping prices high and middle-class families struggling. Policies aimed at building affordable homes often take years to show results, leaving immediate needs unmet.

Rental regulations have not eased the burden either. Middle-income households still face rising rents and fewer options. High mortgage rates add extra pressure, making homeownership harder despite policy efforts.

Many middle-class families are left behind as costs keep climbing faster than wages grow.

Future Outlook for Middle-Class Housing

Housing prices might keep rising, making it even harder for families to buy a home. Changes in policies could either help or hurt middle-income households in the years ahead.

Predictions on mortgage rates and housing prices

Mortgage rates may stay high as inflation pressures continue. In October 2023, the average rate for a 30-year fixed mortgage was around 7-8%, making it harder for middle-class families to afford homes.

Expensive property prices might not drop soon due to a limited housing supply and strong demand in urban areas.

Home prices could rise further in places like California or New York, where inventory is tight. Middle-income families may keep struggling with affordability issues if wages don’t grow fast enough.

Some experts think rental costs will increase too, forcing more people into long-term renting instead of buying homes.

Potential policy shifts and their implications

Governments may push for more affordable housing. They could invest in construction to boost housing supply. This can help middle-class families struggling with high homeownership costs.

Rental regulation policies might limit rent hikes, easing the burden on renters. These shifts aim to reduce financial stress for many people.

Rising mortgage rates and property prices have hurt middle-income households. Policies tackling these issues could narrow wealth inequality gaps over time. If done right, they might also improve generational wealth transfer opportunities among families who currently feel stuck renting instead of owning homes.

Final Words:

The housing crisis has hit middle-class families hard. Homes are too expensive, wages aren’t keeping up, and options are few. Many feel stuck—renting instead of owning or cutting back on other needs.

This struggle keeps growing wealth out of reach for them. Change is needed to protect their future dreams.

Frequently Asked Questions (FAQs)

1. What happens to middle-class families during a real estate crisis?

When housing prices drop or mortgages become unaffordable, many middle-class families face financial stress. They might struggle to pay their bills, lose savings, or even risk losing their homes.

2. How does a real estate crisis affect home values for the middle class?

Home values often fall during a crisis, which hurts middle-class families who rely on their home’s value as an investment or safety net.

3. Why do real estate crises hit the middle class harder than others?

Middle-class families usually have fewer resources to fall back on compared to wealthier groups. A sudden rise in mortgage rates or job loss can quickly lead to financial trouble.

4. Can renting protect middle-class families from a housing crash?

Not always! Renters may still face rising rents if landlords pass on costs—or they could be forced out if properties are sold during tough times.